Awesome Info About How To Buy A Bond

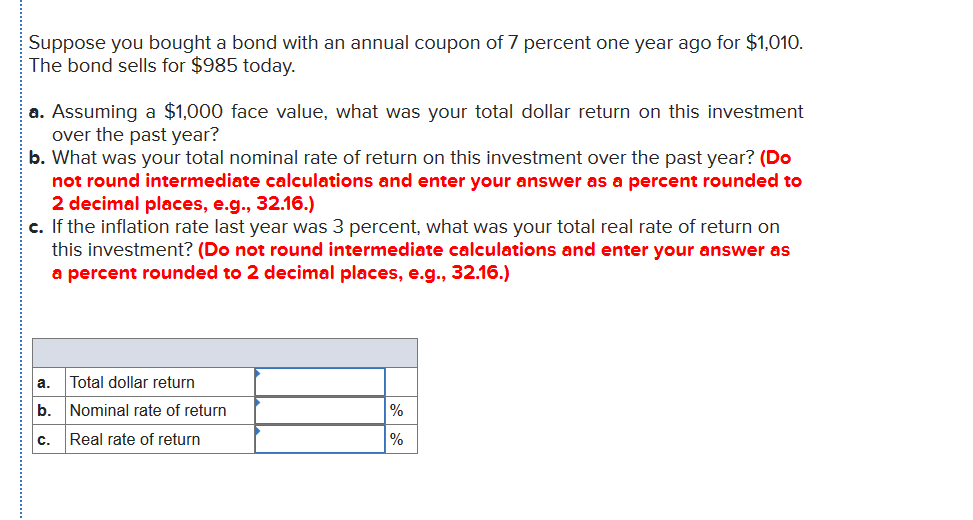

:max_bytes(150000):strip_icc()/dotdash_Final_Bond_Apr_2020-01-63d1901859ed40f5bc7533de1a31e857.jpg)

Investing aug 17, 2023 how to buy bonds in 5 steps by team stash if the terms “bond,” “interest rate,” and “investment” sound like jumbled puzzle pieces to you, don’t worry;.

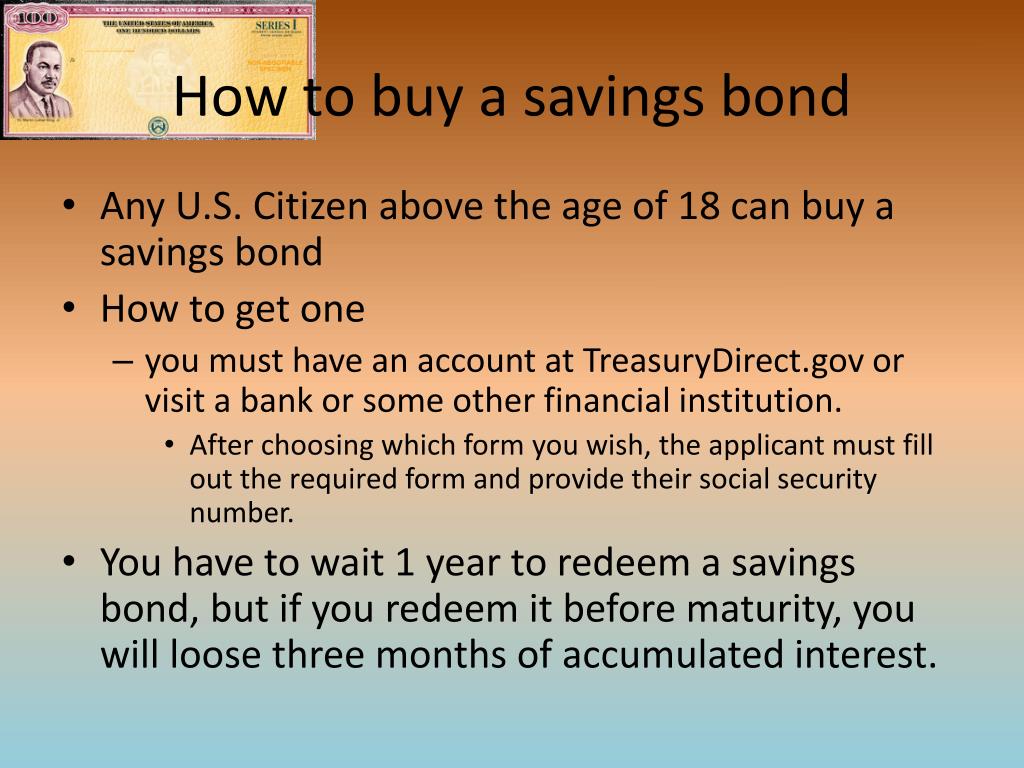

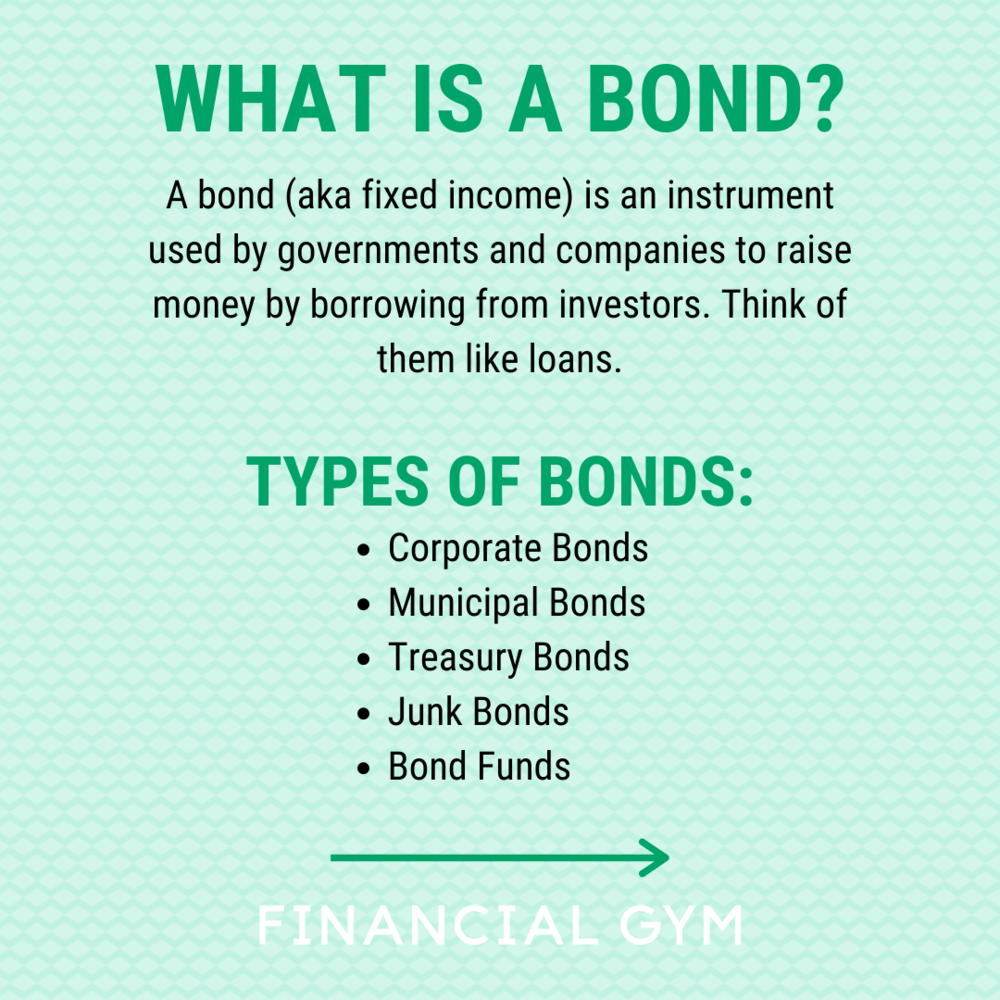

How to buy a bond. Government bonds are recommended as a stable investment offsetting more volatile stocks in a portfolio. Treasury, you can create a treasurydirect account. Bonds are categorized by the entity that issues them.

Therefore, a $1,000 bond with a coupon rate of 5% pays $50 interest each year. Compare the pros and cons of. These can be bought directly over the counter (otc) or via the asx through a broker or an online trading account.

States, cities, and counties issue municipal bonds, sometimes called “munis”, to finance capital expenditures like the building of new roads. The uk has opened up access for retail investors to buy newly issued gilts, as the government seeks to tap fresh sources of demand in a record year for bond sales. Find out how to check the bond's rating, choose the best strategy for your portfolio and avoid common pitfalls.

Learn the different types of bonds and how to evaluate them before you buy through a broker, an etf or directly from the u.s. The yield is the amount of interest the bond pays to its owner, expressed as a percentage of. The face value of these types of bonds is fixed.

Government bonds directly from the government or through brokers, banks and etfs. Trump in his civil fraud case took effect on friday,. Find out the pros and cons of investing in bonds, the types of bonds, and how to buy them.

Learn the basics of bonds, how they work, and how to make money from them. Purchase your bonds or bond funds. Learn how to buy bonds of different types, such as corporate, government, municipal, or foreign, through brokers, online platforms, or directly from issuers.

If you are interested in a bond portfolio, you should know where to invest. Trump is on the clock. Do you want to buy bonds?

To buy bonds through the u.s. With the right approach, you can get as much yield as you would typically get from certificates of deposit (cds) or savings accounts (and often more), though you may. Bond yield is essentially the rate of return the bond generates for the investor on.

How to buy a bond volume 90% 00:00 00:00 read transcript add a bond to your portfolio in just a few steps starting with our fixed income offerings table. Bonds are sold in the primary and.

:max_bytes(150000):strip_icc()/bond-final-f7932c780bc246cbad6c254febe2d0cd.png)

/-1000-denomination-us-savings-bonds-172745598-cdf4a528ed824cc58b81f0531660e9c9.jpg)

-min.png)

:max_bytes(150000):strip_icc()/Open-Market-Operations-OMO-Final-ec375b8eb4d44b4d80b7bb24c6f1c9f2.jpg)

:max_bytes(150000):strip_icc()/what-are-bonds-and-how-do-they-work-3306235_V3-cc55a8d3b82d4d34a991d6cc4fa8a865.png)