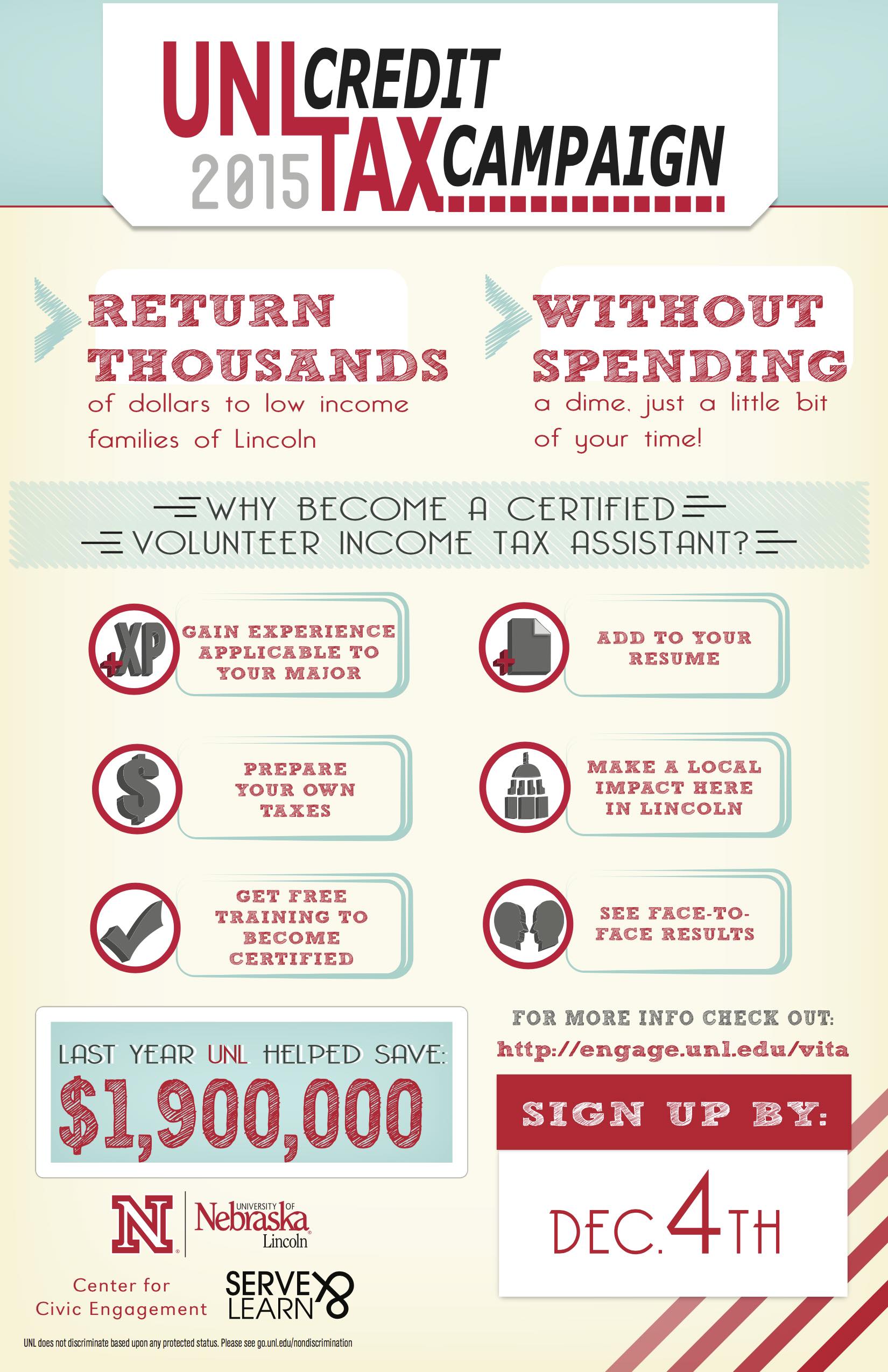

Ace Tips About How To Be A Certified Tax Preparer

While in high school, you can focus on.

How to be a certified tax preparer. If you're interested in becoming a tax preparer, here are some steps to follow: The question is, how do you become certified to prepare taxes? Any tax professional with an irs preparer tax identification number (ptin) is authorized to prepare federal tax returns.

For most new tax preparers, learning the ins and outs of the business means acquiring an entirely new professional language. However, tax professionals have differing levels of skills,. Other preparers can help you with forms and basic matters but cannot represent you in case of an audit.

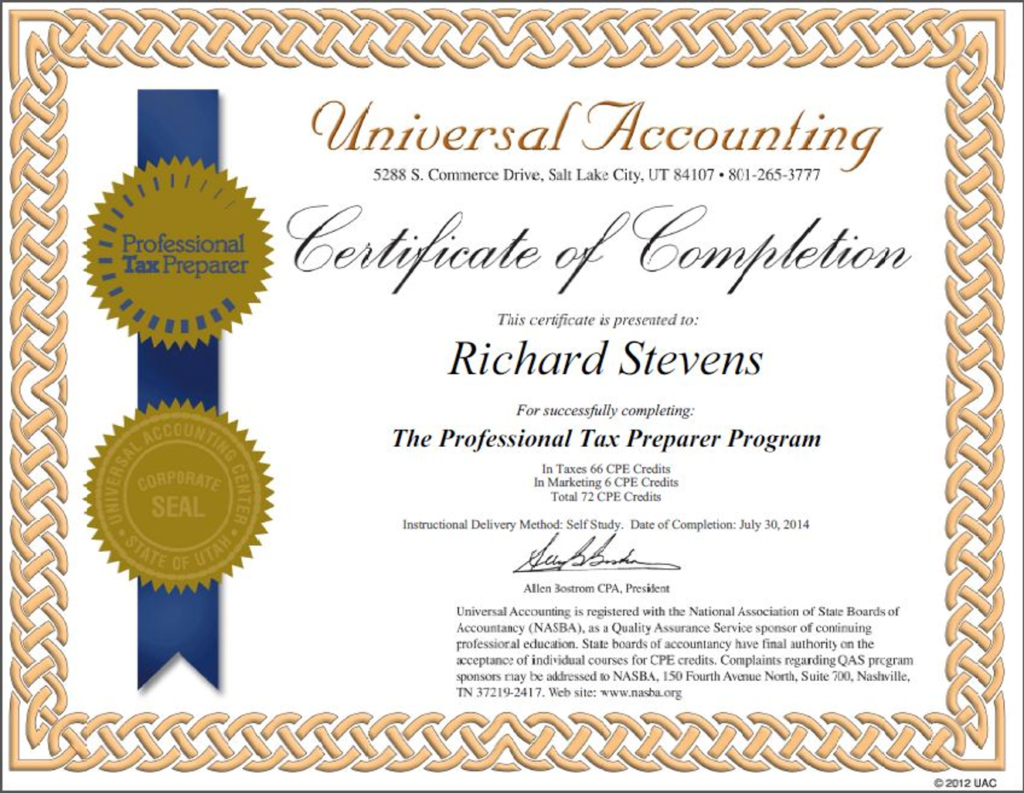

Written by coursera staff • updated on jan 3, 2024 tax accountants use their knowledge of tax laws and regulations to prepare, file, and manage the taxes of. Additionally, obtaining certifications such as the accredited tax preparer (atp) credential from the accreditation council for accountancy and taxation (acat) can demonstrate a. Paths to becoming a tax preparer.

$345 (new client), $332 (returning client) set fee per form and. To obtain the atp certification, tax preparers must pass an exam covering federal tax law and ethics, and meet education and experience requirements. There are no minimum requirements to be a tax preparer.

Don’t be afraid to ask about these or other qualifications before you hire. You obtain it from the irs. Register with the irs and receive a preparer tax identification number (ptin).

Get a preparer tax identification (ptin) number from the irs. Earning a high school diploma or a general educational development (ged) test is the first step to becoming a tax preparer. If, however, you plan on.

Ce requirements vary by state. There are various types of tax return preparers, including certified public accountants, enrolled agents, attorneys, and many others who don't have a professional. Complete your education a high school diploma or ged is the minimum.

You go outside to check your mail and you've got an irs au. According to salary.com, the typical personal trainer salary ranges between $48,446 and $82,489, with the average resting at $67,141 as of january 26, 2024. Minimum fee, plus complexity fee:

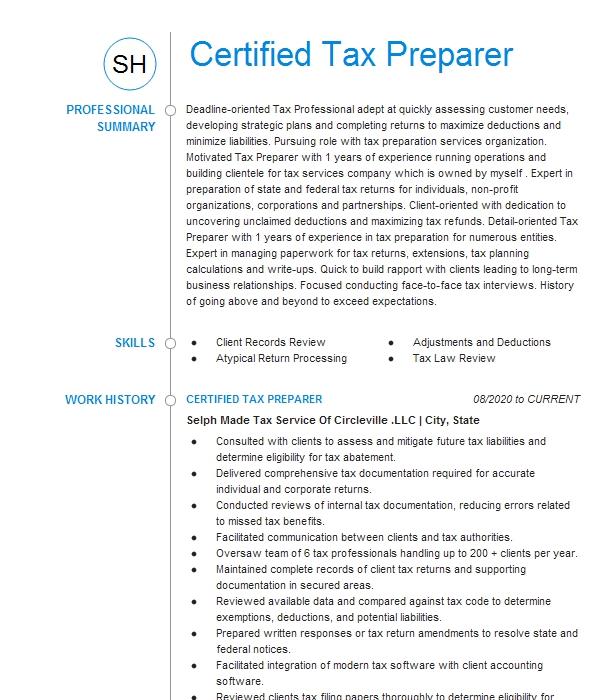

As mentioned above, you need a ptin number to prepare income taxes. A comprehensive guide on becoming a certified irs tax preparer involves a series of basic steps which are essential to follow. Definition of a tax preparer.

To become a ctec registered tax preparer, you must: A tax preparer is a financial professional who specializes in preparing and filing income tax returns for individuals and businesses. Here’s what tax preparers charge, on average, by fee method: