Awesome Tips About How To Write An Abatement

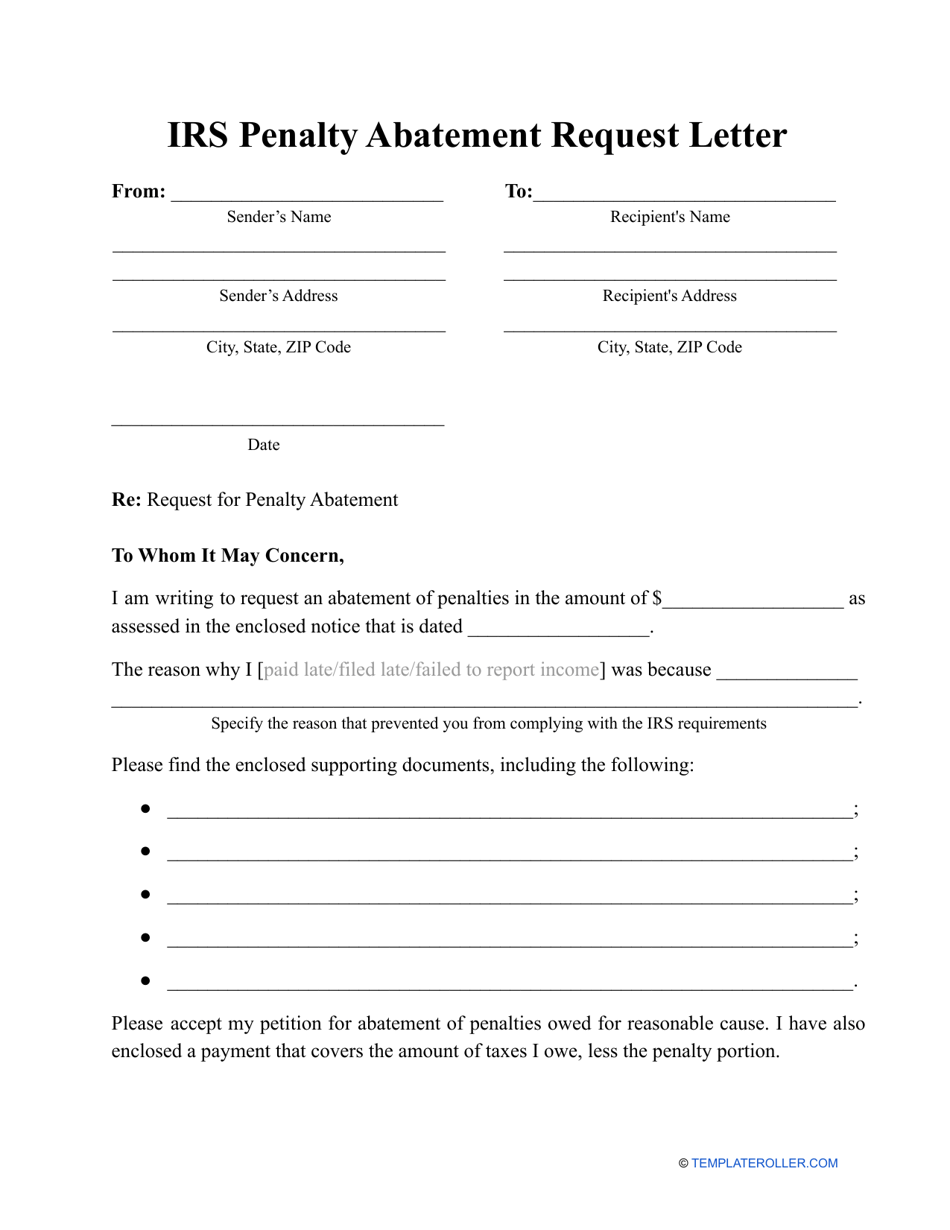

Result if we cannot approve your relief over the phone, you may request relief in writing with form 843, claim for refund and request for abatement.

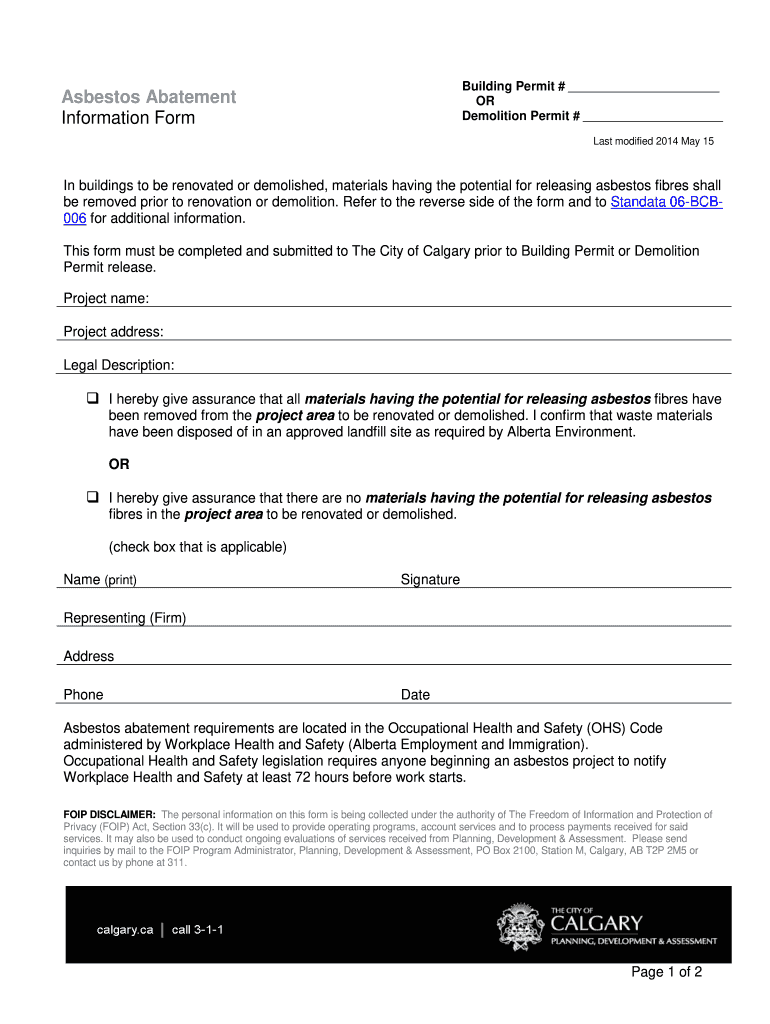

How to write an abatement. You may qualify for relief from. Result find out about the irs first time penalty abatement policy and if you qualify for administrative relief from a penalty. The suspension or termination of a legal action due to certain circumstances.

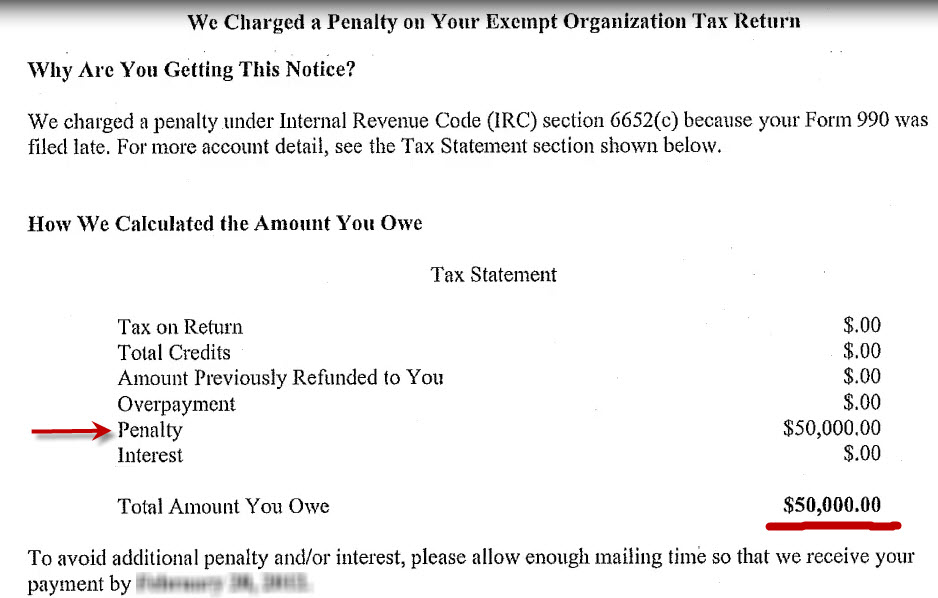

Result to do this, your penalty abatement letter needs to clearly state the facts of your case, cite the relevant law, then apply the law to the facts, coming to. Before you begin writing your letter, familiarize yourself with the criteria that the irs considers for. So, if you only received a $50 penalty in.

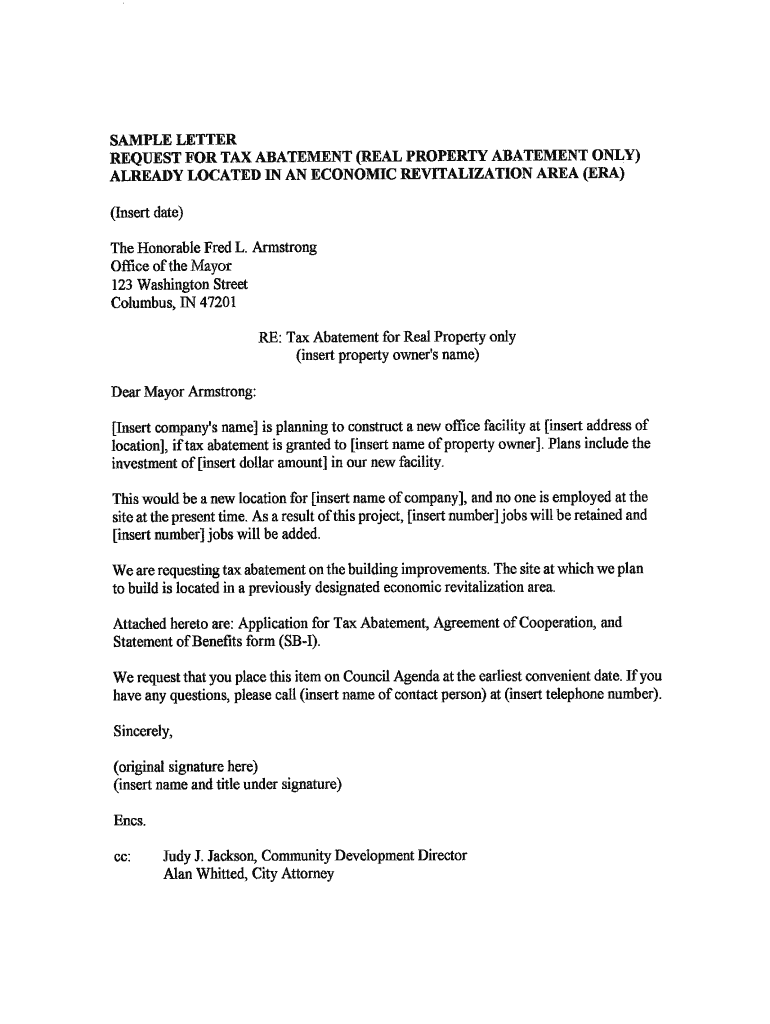

Result here is a sample of how to write a letter to the irs to request irs penalty abatement. Result abatement is simply removing the penalties after they are assessed to the taxpayer. Result sample abatement letter.

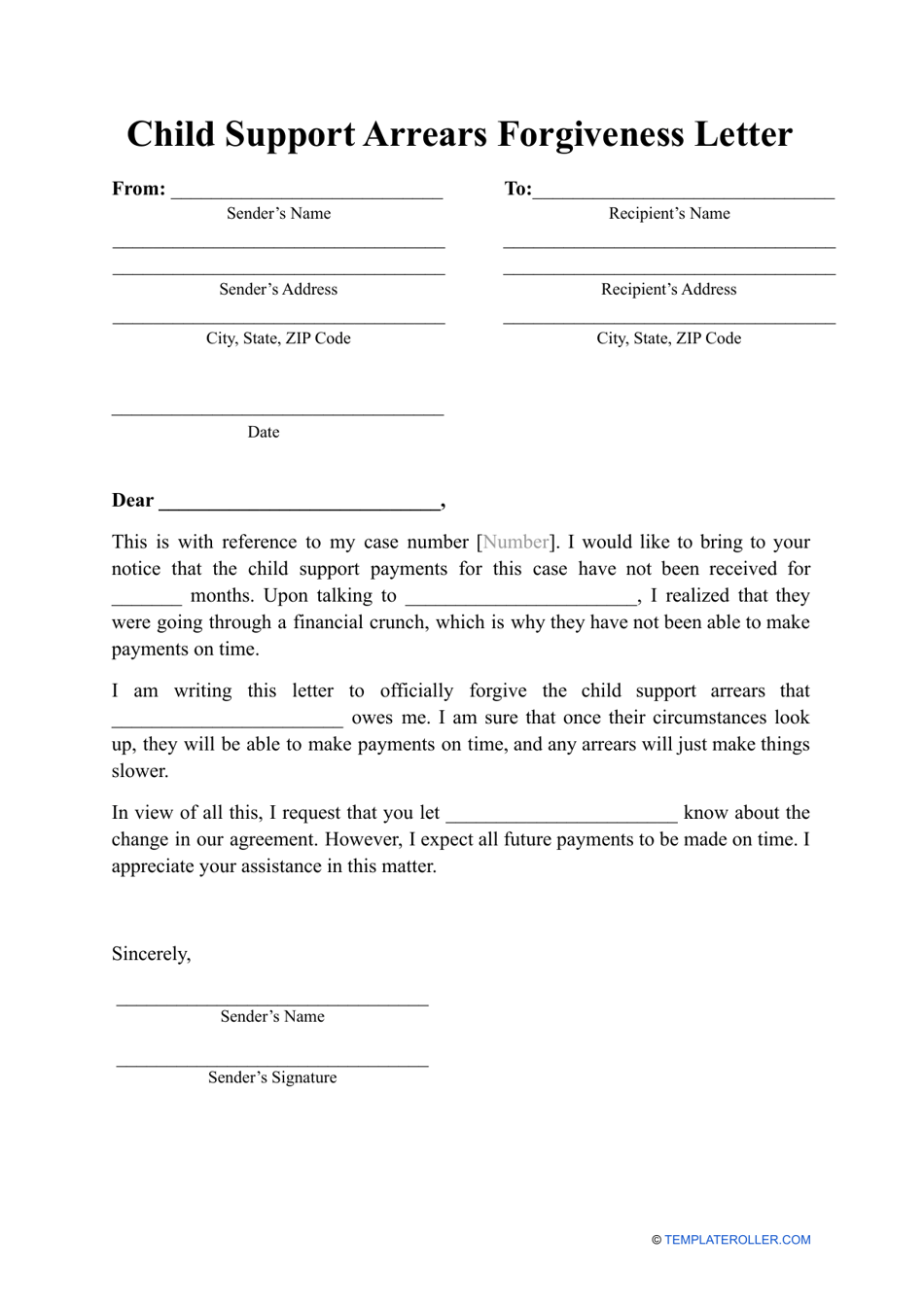

In legal proceedings, abatement can refer to: Here are four unique templates for tenant requests for rent. No irs penalties for the three prior tax years.

I am writing to request an abatement of penalties in the amount of $. The irs will only consider penalties that are over $100. Result if you are a tenant struggling to pay rent, you may be able to request a rent abatement.

Failure to file (ftf) and failure to pay (ftp) penalties generally. These two templates can help you write a letter based on. You can use these two.

Result [your name] [your address] [your social security number] [mmm dd, yyyy] dear sir/madam: Here are sample letters to request irs penalty abatement. Result here is how you should prepare a letter to the irs for penalty abatement:

Sample irs penalty abatement request letter. An abatement is a reduction or an exemption. Result step 1: