Awe-Inspiring Examples Of Info About How To Start Your Bank

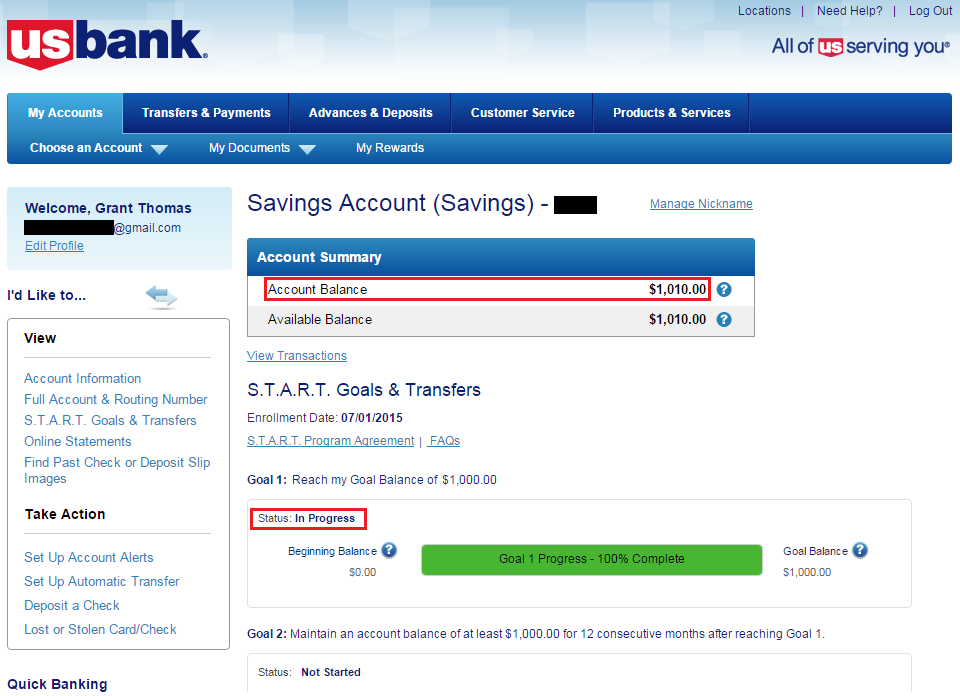

In 2024, the 401 (k) limit increased to $23,000 and the ira limit grew to $7,000.

How to start your bank. How to start an offshore bank. 1 determine a need. Find an experienced insurance agent who specializes in “infinite banking” policies:

The plan must consider the proposed business of the new bank, its financial and managerial resources and prospects for success, the convenience and needs of the public, and the effect on competition. Decide if the business is right for you pros and cons starting a bank has pros and cons to consider before deciding if it’s right for you. This involves giving a detailed account of your bank’s business plan, capital setup, risk management infrastructure, management team, and how well you adhere to regulations.

These are not your typical off the shelf products, most life insurance agents don’t even know how to do this. Business plan and financial forecast. Start a bank by following these 10 steps:

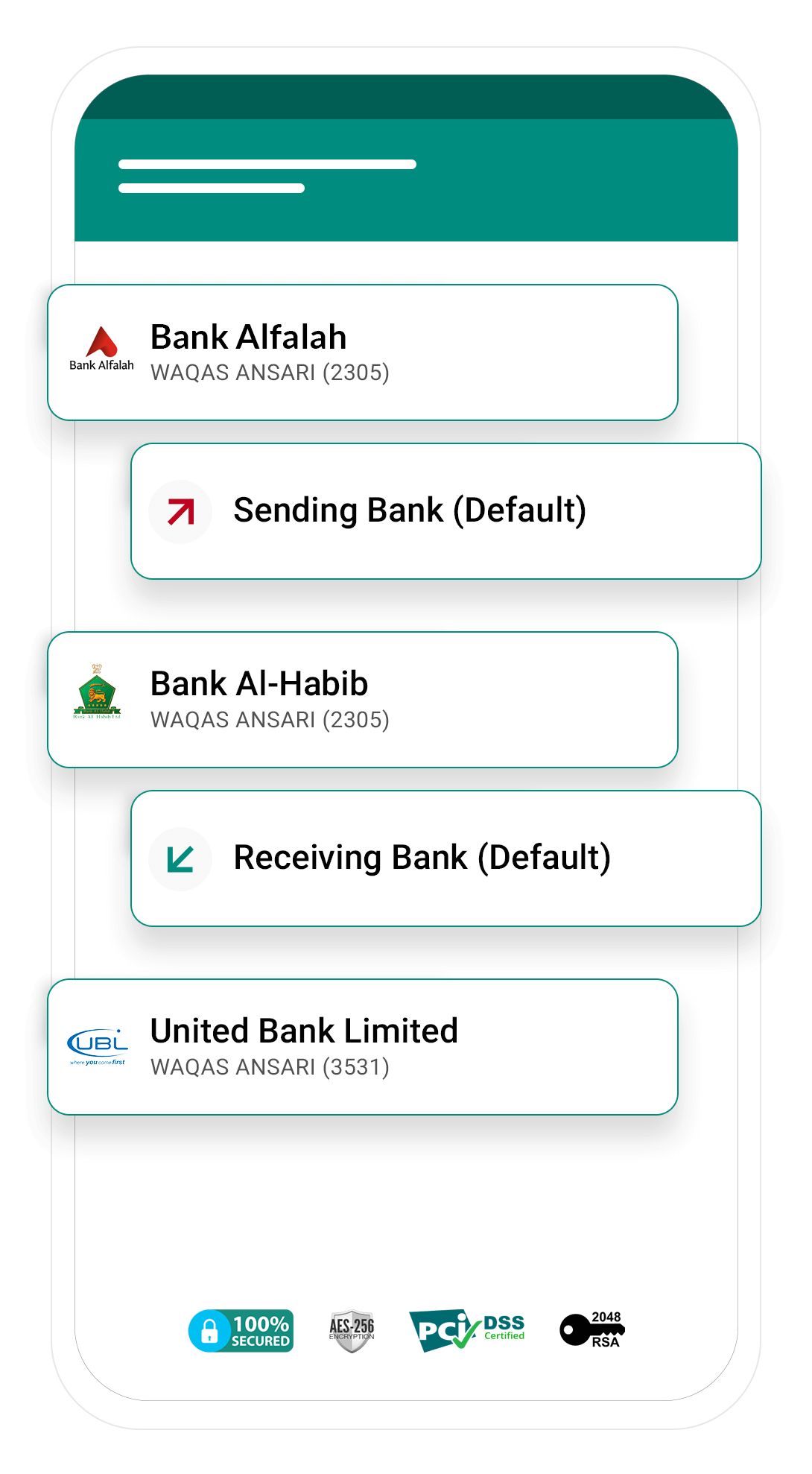

You can open a bank account online by completing an online application with a bank, provided you can fund the new account with an existing bank account. Starting a bank involves a long organization process that could take a year or more, and permission from at least two regulatory authorities. That's because starting a bank requires a lot of.

How to start a fintech bank. Register your bank for taxes; Open a business bank account & credit card;

You’ll learn the different types of banking charters available, capital requirements, regulations, licensing processes, choosing a location, developing products and services, building a team, marketing strategies, and more. Know the business most of us are familiar with banking on quite level, whether it be through checking and savings accounts, mortgages or loans, total cards, retirement accounts, or security policies. The type of charter needed will depend on various factors, such as the bank’s business model, location, and target market.

2 appoint a board of directors. This starts with understanding how banking works, and the different types of options that are available to you as a customer. How can i start a bank?

Even if you can’t make it to these numbers, try to increase the amount you. You can take the name of your online bank business from your industry, focus on a geographical location, or use your name, among other options. If you’re not currently maxing out your retirement savings each year, consider making this a habit — or at least get closer to meeting this goal.

Fully describe risk management protocol. And just 10 new federally chartered banks opened in the first three quarters of 2019. At the end of the auction, the best offers are accepted.

Download article ask yourself the important questions. On the low end of the spectrum, the capital requirements can range between usd 300,000 to usd 5,000,000. Each year, according to carpenter.