Stunning Tips About How To Buy Singapore Government Bonds

A bank account with dbs/posb, ocbc and uob.

How to buy singapore government bonds. What determines the interest rates on bonds? Singapore — singapore’s budget deficit widened more than expected in 2023 but the country expects a small surplus in the 2024 financial year, deputy prime. When investing in bonds in singapore, the.

When you invest in these bonds, you essentially place your money in the safest place possible. Open a bank account online or visit any of the banks' branches in singapore to open an account. The singapore savings bonds (sgs) may have gained a lot of traction in popularity lately due to rising interest rates, but there's also another government bond.

Here are some of the best types of bonds to buy in singapore: The singapore savings bond is a special type of bond that the singapore public has access to. To invest in sgs bonds, you are required to be above 18 years old.

That mainly came from pfizer’s. Subscribe are singapore savings bonds safe? How to buy singapore government bonds?

Ssb is arguably one of the safest products on the market. How to buy and sell bonds in singapore. The singapore government’s “aaa” credit rating and.

And international business machines corp. You will also have to invest a minimum of $1,000, and in multiples of $1,000. A potential tax benefit is spurring us companies including pepsico inc.

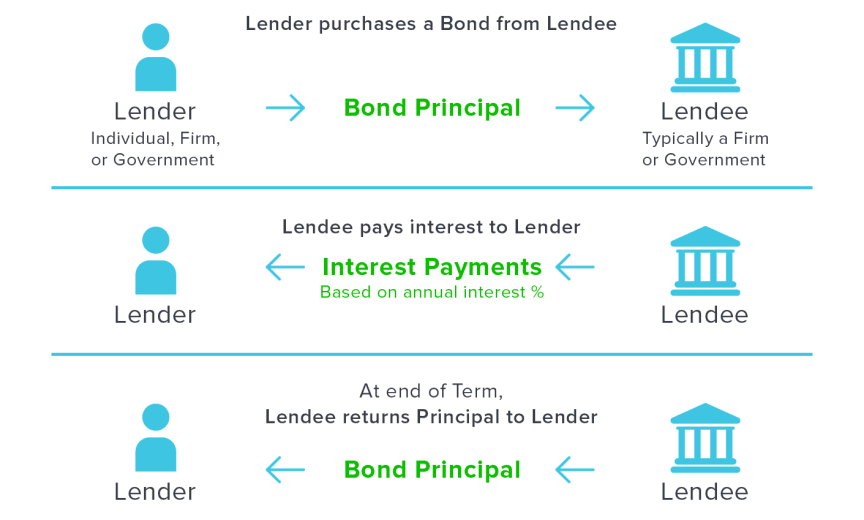

Complete guide to investing in corporate bonds in singapore corporate bonds typically pay investors higher interest rates, as they carry more risks than. When you buy a government bond, you lend the government an agreed amount of money for an agreed period of time. Bonds can be bought easily through several avenues.

To sell bonds through their singapore. An individual cdp securities account with direct crediting service activated. The way you can buy and sell a bond differs depending on the.

:max_bytes(150000):strip_icc()/WherecanIbuygovernmentbonds1_2-8e2ac360d217459eb54ebea0070eb5b5.png)

![What are Government Bonds & How Do They Work? [Guide]](https://emozzy.com/wp-content/uploads/2021/02/government_bonds-1920x1080.jpg)

![What are Government Bonds & How Do They Work? [Guide]](https://emozzy.com/wp-content/uploads/2021/02/What-are-Government-Bonds-How-Do-They-Work-Guide-2.jpg)

![What are Government Bonds & How Do They Work? [Guide]](https://emozzy.com/wp-content/uploads/2021/02/government_bonds__1_-1920x1080.jpg)

![What are Government Bonds & How Do They Work? [Guide]](https://emozzy.com/wp-content/uploads/2021/02/government_bonds__3_.jpg)

:max_bytes(150000):strip_icc()/bond-final-f7932c780bc246cbad6c254febe2d0cd.png)