Have A Info About How To Buy Oil Futures Options

Futures contracts are agreements to buy or sell a standardized amount of an asset at a specific price on a specific future date.

How to buy oil futures options. Learn how to trade crude oil futures options on the new york mercantile exchange (nymex) or the chicago mercantile exchange (cme) with schwab. Buying the future requires putting up an initial margin of $8,350—this amount is set by the cme, and varies by futures contract—which gives control of 100. Crude oil storage tanks are seen from above at the cushing oil hub, in cushing, oklahoma, march 24, 2016.

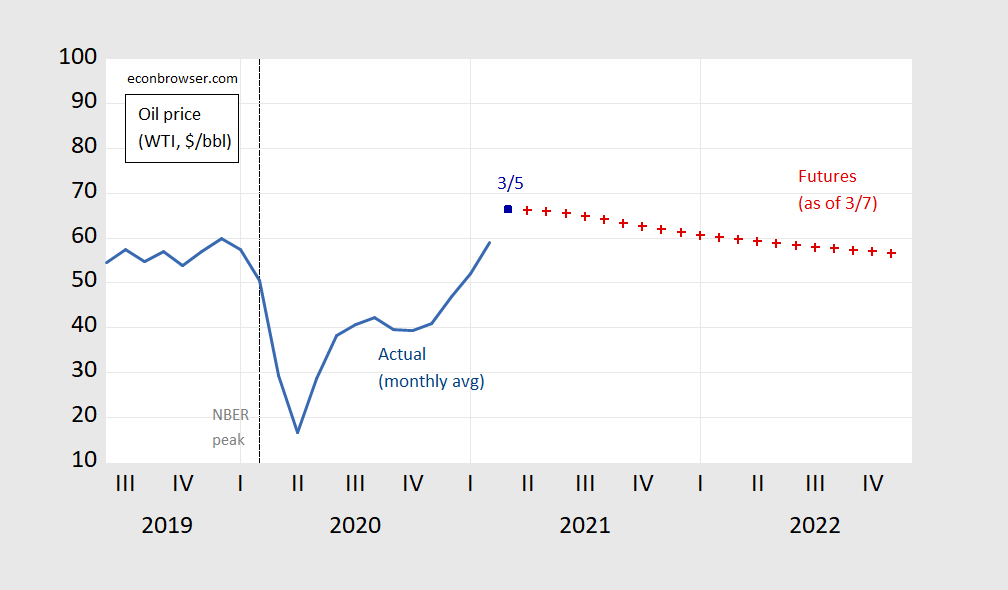

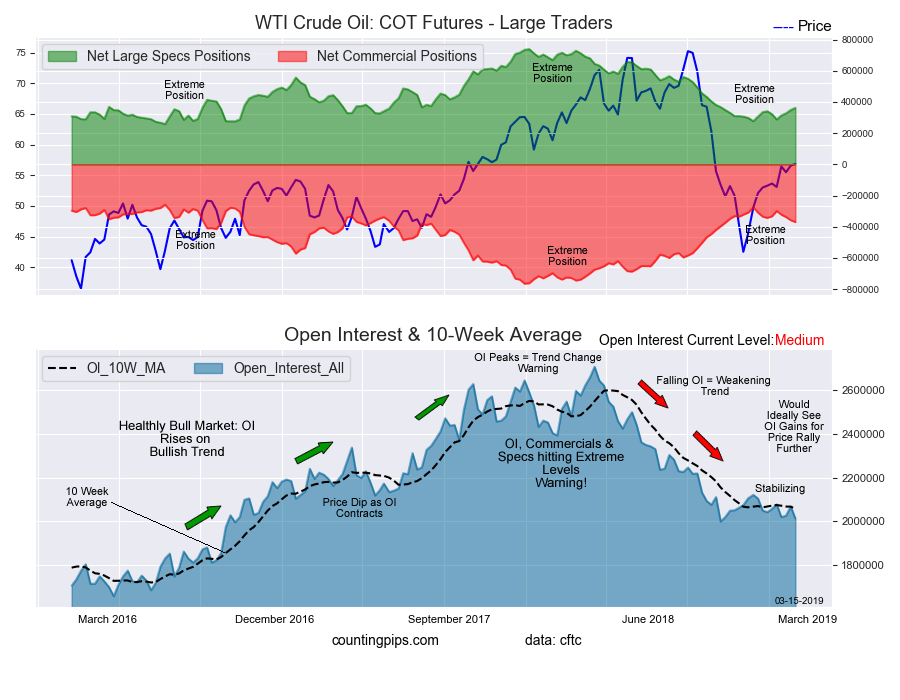

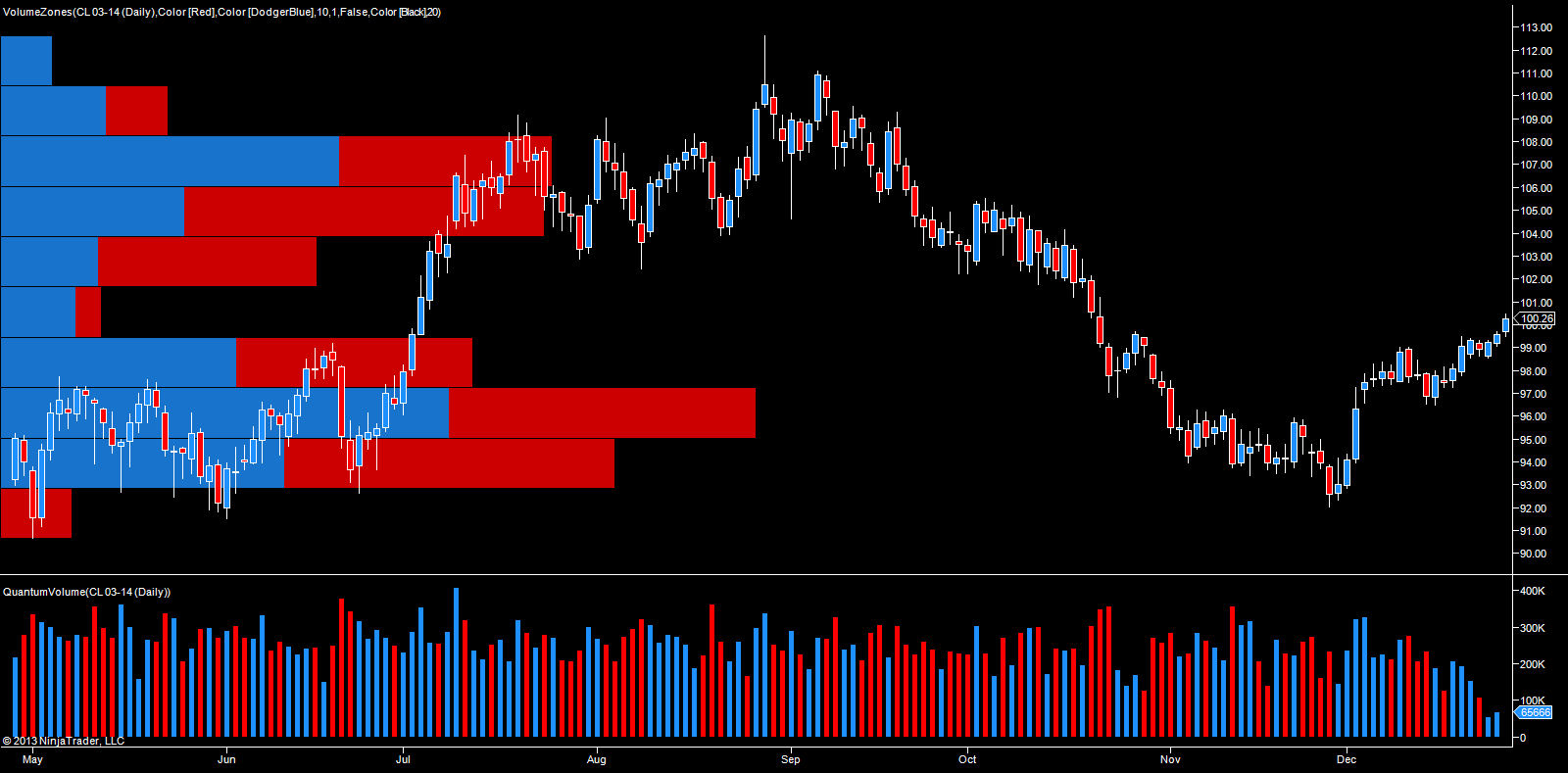

Direct investment in oil futures investors can purchase oil futures contracts, which give them the right to buy or sell a specific amount of oil at a. Commodities oil introduction to trading in oil futures by greg mcfarlane updated march 04, 2021 reviewed by khadija khartit fact checked by ariel courage it’s. Follow the steps required by the trading platform to submit and complete a buy order.

The final step in the process is to find and open a brokerage trading account that supports oil futures. Find out the risks, benefits and alternatives of investing in oil as an asset. Discover how to trade oil options using spread betting, cfds and with a broker in the uk.

Decide which oil market to focus on. Find out what oil options are and how you can trade them. Crude oil futures fell slightly wednesday as the.

Future contracts are an agreement between producers and. Pick a broker and open a trading account. Wti and brent futures contracts.

All futures & options contracts have symbols which are used to identify the contracts you wish to trade. In reality, the publicly traded price of oil is reflective of the future’s price from a specific location. For wti crude oil, the root symbols are… futures:

Plus, the crude oil market is also very liquid (in financial terms), and around rs. The most a crude oil option holder can lose is the cost paid for the option, rather than the cost of the underlying futures contract. Options prices are delayed at.

Our diverse wti futures and. Follow these three steps: Options contracts give purchasers the right, but not the obligation, to buy (call option) or sell (put option) the underlying asset at a preset strike price.

For instance, if you want to trade in rs 50 lakh worth, you only have to deposit rs 2.5 lakh in margins. For instance, assume that on september 25, 2014, helen the trader enters into a long call position in european crude oil options on february 2015 crude oil futures at a strike. Learn how to trade oil futures and options, related etfs and etns, and energy stocks.

Trade cfds on oil etfs.

:max_bytes(150000):strip_icc()/Futures-19f64f0cf82148619e4d485cdb5b2c19.jpg)